Microsoft 2022Q2 Memo

企業軟件市場仍然健康,而Azure與其他雲的成長率拉近後,不知道有沒有辦法持續追趕AWS,其次廣告PC市場開始看到需求疲軟的狀況,最後,微軟產品真的太多了,沒辦法一下看很懂..

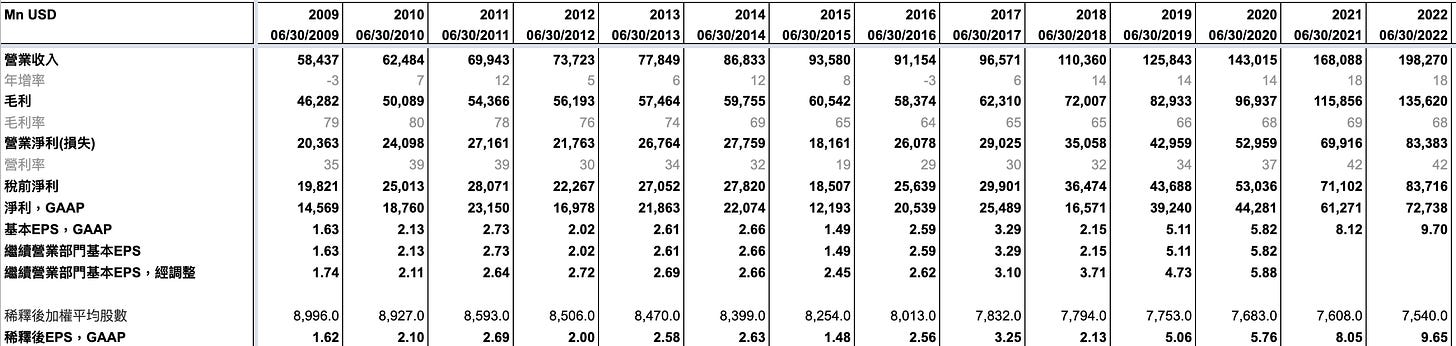

財務數據

年

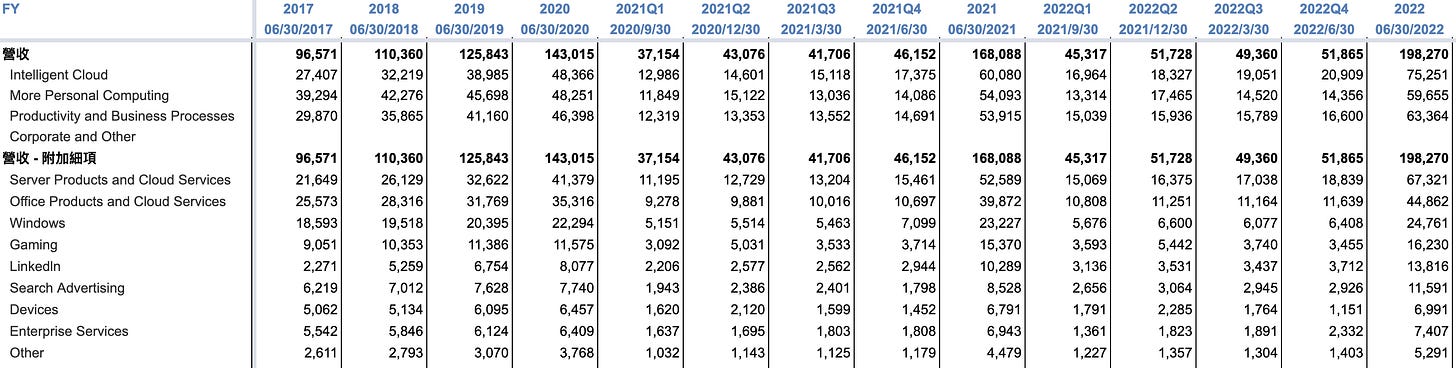

季

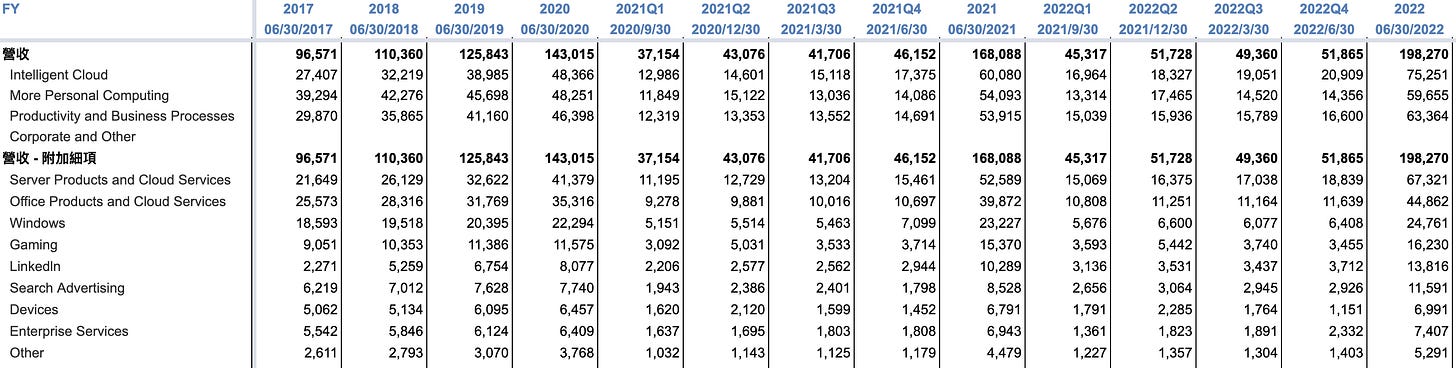

部門營收

部門營收年增率

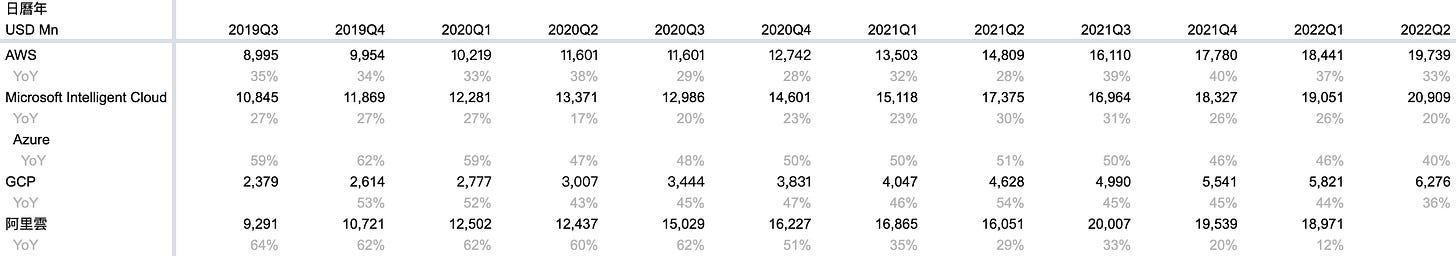

三大公有雲營收季度資料(日曆年,比較好比較)

三大公有雲營收年度資料(日曆年,比較好比較)

Highlight

Context

PC市場與廣告支出持續疲軟

Continued weakness in the PC market demand and advertising spend will impact Windows OEM, Surface, LinkedIn and Search and news advertising revenue.

商業訂單上仍然非常強健:大型訂單增加、我們認為IT支出佔GDP的比例會持續上升

In commercial bookings, strong execution across our core annuity sales motions and increased commitment to our platform should drive healthy growth on a flat expiry base. As a reminder, the growing mix of larger long-term Azure contracts, which are more unpredictable in their timing, always drive increased quarterly volatility in our bookings growth rate. There are 2 things at least I've observed. One is the -- whether the bookings number or the Mac deals and the size of the Mac deals and the number of them, I think, speak to very much what we have been talking about for a long time now, which is as a percentage of GDP, IT spend is going to increase because every business is trying to fortify itself with digital tech to, in some sense, navigate this macro environment. So that, I think, is probably what is reflected in those numbers.

公司

我們將專注三件事:提供從基礎建設到商業應用與混合辦公的獨特商業價值、投資在持續爭取市佔與在我們具有長期競爭優勢的地方建立新業務、我們將在此期間專注於優先且執行良好的營運上,強化營運槓桿。

In this environment, we are focused on 3 things: first, no company is better positioned than Microsoft to help organizations deliver on their digital imperative so that they can do more with less. From infrastructure and data to business applications and hybrid work, we provide unique differentiated value to our customers. Second, we will invest to take share and build new businesses and categories where we have long-term structural advantage. Lastly, we will manage through this period with an intense focus on prioritization and executional excellence in our own operations to drive operational leverage.

產品

Azure:我們看到越來越多大型長期的合約,本季超過1億美元及10億美元的訂單創紀錄

Organizations in every industry continue to choose our cloud to align their IT investments with demand. We are seeing larger and longer-term commitments and won a record number of $100 million-plus and $1 billion-plus deals this quarter. We have more data center regions than any other provider, and we will launch 10 regions over the next year.

Data 與 AI:我們提供完整的資料架構,從營運資料庫、分析到合規,幫助客戶專注在創造價值而非整合碎片化的資料。超過65%的財富五百客戶使用三套以上我們的Data解決方案

With our Microsoft Intelligent Data Platform, we provide a complete data fabric spanning operational databases, analytics and governance, helping customers focus on creating value instead of integrating fragmented data estate. More than 65% of the Fortune 1000 use 3 or more of our data solutions, and we are growing faster than the market. We are seeing leaders in every industry from LaLiga and Lenovo to Swiss Re and Walgreens unify their data using our tools. Cosmos DB is the go-to database powering the world's most demanding mission-critical workloads at any scale. Transactions in data volume increased over 100% year-over-year for the fourth quarter in a row.

When it comes to AI, we are seeing a paradigm shift as the world's large AI models become powerful platforms themselves. With our Azure OpenAI service, a diverse set of customers from HSBC, PwC and RTL Group to Shell and Wipro are applying language models to advanced scenarios like content and code generation.

開發者工具:GitHub推出自己的AI pair programmer,幫助工程師寫程式更好更快速,推出一個月以內,超過40萬個工程師訂閱。

Now on to developer tools. We have the most popular developer tools across any cloud and any platform. Leaders in every industry from Ahold Delhaize to KPMG to Philips are all choosing GitHub to build software. GitHub Copilot is the first-of-its-kind AI pair programmer, which helps developers write better code faster. More than 400,000 people have subscribed since we made it generally available a month ago.

Windows:我們正在經歷從Windows轉型到Windows 365與Azure Virtual Desktop的過程,Azure Virtual Desktop的月活躍用戶本季年增60%

We are transforming how Windows is experienced and managed with Azure Virtual Desktop and Windows 365. Azure Virtual Desktop monthly active usage increased nearly 60% year-over-year.

資安:我們提供完整的解決方案,整合了50個項目,每天處理43兆的信號,也幫助客戶降低成本與複雜性。資安的營收本季增長40%。

As the rate and pace of threats continue to accelerate, security is the top priority for every organization. We provide comprehensive solutions that integrate more than 50 categories informed by more than 43 trillion signals each day, reducing cost and complexity. We're taking share across all major categories we serve. All up, our security revenue increased 40%.

LinkedIn:用戶數達8.5億人、超過40%的公司使用LinkedIn時使用Skill Filter 尋找他們的應徵者。LinkedIn Talent Solution營收過去12個月超過60億美元(約43% LinkedIn營收),LinkedIn廣告營收首次超過50億美元(約36% LinkedIn營收)。

We once again saw record engagement among the more than 850 million members, a testament to how mission-critical the platform is to connect job seekers with jobs, learners with skills and marketeers with buyers. We are seeing job candidates and employers alike prioritize skills to more efficiently find and source work. More than 40% of the companies on LinkedIn now rely on skills filters to identify candidates.

LinkedIn Talent Solutions surpassed $6 billion in revenue over the past 12 months, up 39% year-over-year. And LinkedIn Marketing Solutions surpassed $5 billion in annual revenue for the first time. We are a leader in B2B digital advertising, and we continue to see customers choose us for higher reach and ROI. More broadly, despite the current headwinds in the ad market, we are expanding our opportunity in advertising as we look towards the long term.

財務預估

Activision將在FY2023年末併表

雲產品的折舊年限從4年調整為6年,主因為軟體增加了伺服器、網通設備的效率。

We are extending the depreciable useful life for server and network equipment assets in our cloud infrastructure from 4 to 6 years, which will apply to the asset balances on our balance sheet as of June 30, 2022, as well as future asset purchases. Investments in our software that increased efficiencies in how we operate our server and network equipment as well as advances in technology have resulted in lives extending beyond historical accounting useful lives. This change only impacts the timing of depreciation expense in the future for these assets.

營收、營業利益:2023年將雙位數增長