財務

2023Q2 營收 32 Bn (YoY 11%),營業利益 9.3 Bn (29% 利益率),若還原一次性重組費用780 Mn以及法律成本 1,870 Mn,則常態營業利益 12 Bn (37.6%利潤率)

從部門別利潤來看,FOA營業利益 13 Bn (41% 利潤率),若加回一次性成本費用,則常態營業利益為 15 Bn(49.3% 利潤率),已經回到2021年的水準。

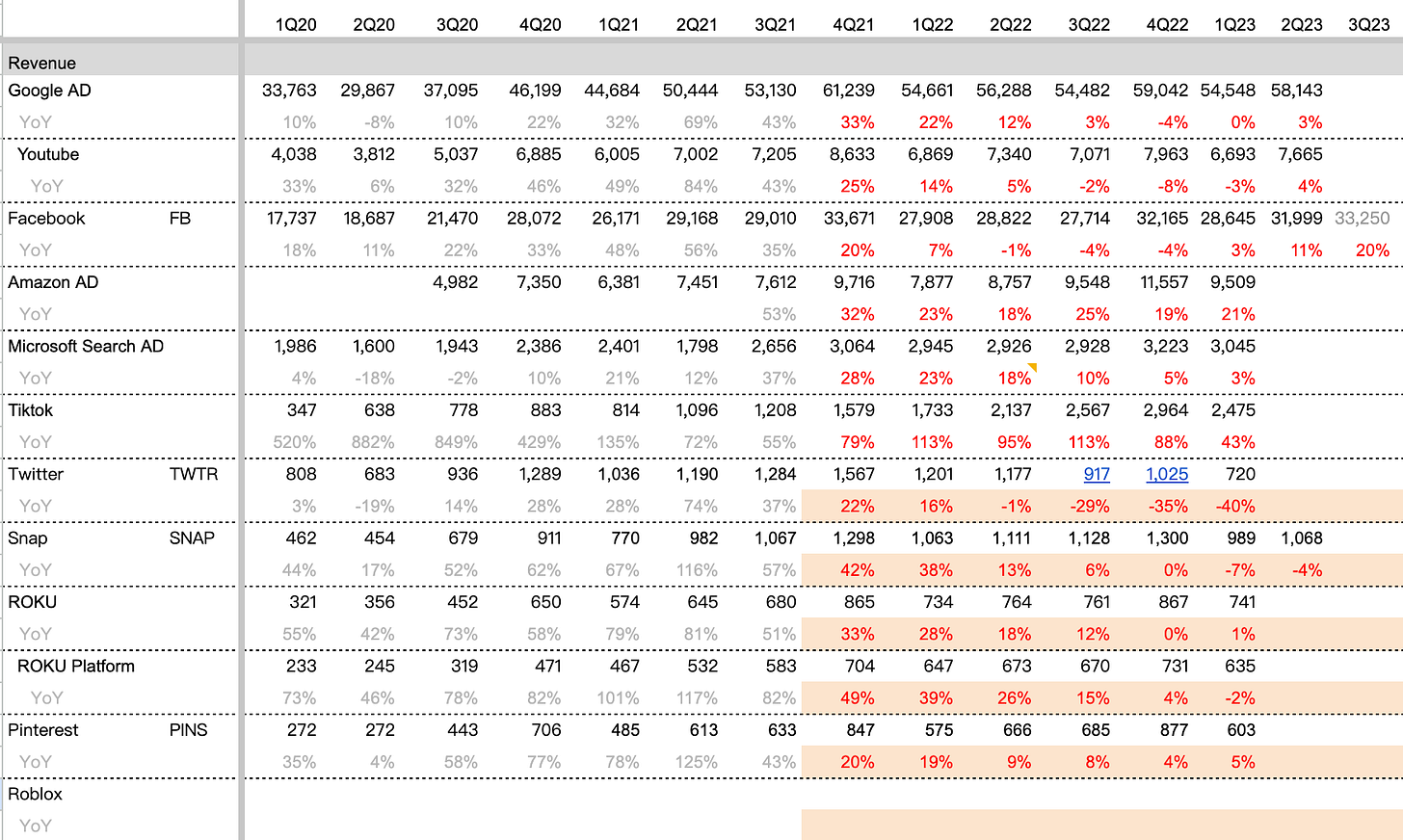

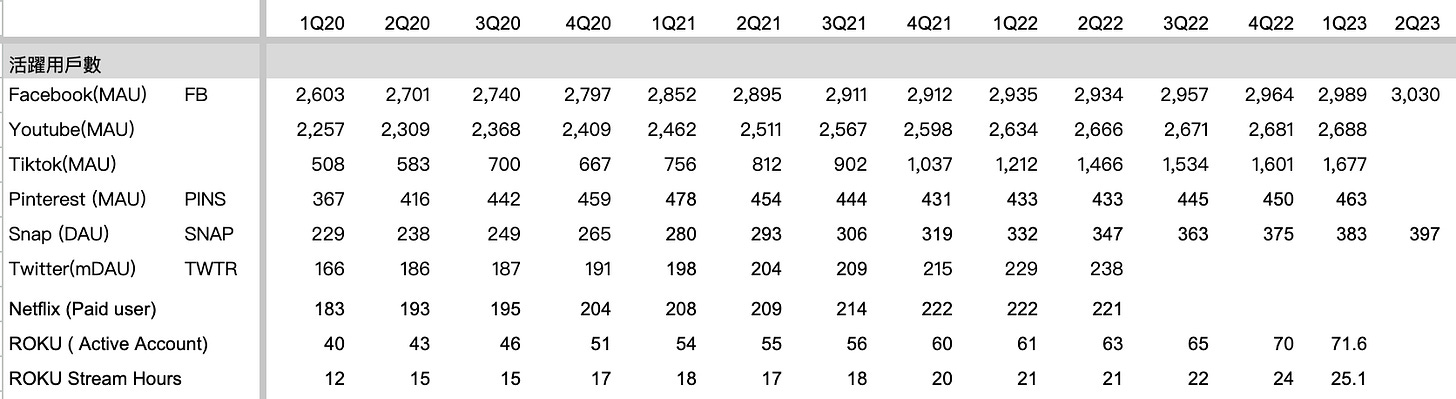

廣告同業數字

Highlight

生意

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

Threads我們專注在留存及改善基礎,接下來我們將專注在社區成長,最後專注在變現。我們已經執行這個方式非常多次了,從FB, IG, Whatsapp, Stories, Reels。

On Threads, now we're focused on retention and improving the basics.And then after that, we'll focus on growing the community to the scale that we think is going to be possible. Only after that are we going to focus on monetization. We've run this playbook many times before with Facebook, Instagram, WhatsApp, Stories, Reels and more, and this is as good of a start as we could have hoped for. So I'm really happy with the path that we're on here.

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

效率年有兩個目標:變成更強健的科技公司、改善財務結果。我們現在已經完成主要的裁員,接下來我們將穩定員工數量,移除降低速度的障礙、使用AI工具加速開發。我們未來也會持續在關鍵領域招聘。The year of efficiency was always about 2 different goals: becoming an even stronger technology company and improving our financial results so we can invest aggressively in our ambitious long-term road map. Now that we've gotten through the major layoffs, the rest of 2023 will be about creating stability for employees, removing barriers that slow us down, introducing new AI-powered tools to speed us up and so on.

That said, as part of this year's layoffs, many teams chose to let people go in order to hire different people with different skills that they need, so much of that hiring is going to spill into 2024. The other major budget point that we're working through is what the right level of AI CapEx is to support our road map. Since we don't know how quickly our new AI products will grow, we may not have a clear handle on this until later in the year.

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

我們正在參與兩個科技浪潮:短期內是AI,長期是Metaverse。過去數年我們花在AI基礎建設上達數十億美元,這些投資透過排名及推薦系統、改善參與度、貨幣化得到回報。

自從推薦系統上線後,增加了7%的用戶時間。I've said on a number of these calls that the 2 technological waves that we're riding are AI in the near term and the metaverse over the longer term.

Investments that we've made over the years in AI, including the billions of dollars we've spent on AI infrastructure, are clearly paying off across our ranking and recommendation systems and improving engagement and monetization.

Now since introducing these recommendations, they've driven a 7% increase in overall time spent on the platform.

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

Reels是Discovery 引擎的關鍵部位,目前Reels 每天播放2000億次,年化營收達100億美元(約8%近四季營收),去年秋天為30億美元。Reels is a key part of this discovery engine. And Reels plays exceed 200 billion per day across Facebook and Instagram. We're seeing good progress on Reels monetization as well, with the annual revenue run rate across our apps now exceeding $10 billion (8% TTM Rev), up from $3 billion last fall.

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

AI持續透過自動廣告產品驅動貨幣化,我們認為這是Meta優勢。幾乎所有我們的廣告客戶使用至少一種我們AI驅動的產品Beyond Reels, AI is driving results across our monetization tools through our automated ads products, which we call Meta Advantage. Almost all our advertisers are using at least one of our AI-driven products.

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

近期我們宣布了WhatsApp 廣告,不需要Facebook帳號即可使用,在許多國家WhatsApp通常是線上商務的第一步。Business messaging is another key piece of our monetization strategy. We recently announced that the 200 million users of our WhatsApp Business app will now be able to create click-to-WhatsApp ads for Facebook and Instagram without needing a Facebook account. This is a pretty big unlock, particularly in countries where WhatsApp is often the first step to bringing a business online.

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

我們正在打造生成式AI的產品,透過與微軟合作推出開源LLM Model Llama 2,供人商業使用或研究使用。我們發現開源能讓整個產業,包括我們,受益於創新。這樣弓長可以更快的改善安全及資安,因為更多人可以發現或修正bug。我們也透過Llama打造自己的產品服務Beyond the recommendations and ranking systems across our products, we're also building leading foundation models to support a new generation of AI products. We've partnered with Microsoft to open source Llama 2, the latest version of our large language model and to make it available for both research and commercial use. We have a long history of open sourcing our infrastructure and AI work from PyTorch, which is the leading machine learning framework, to models like Segment Anything, ImageBind and DINO to basic infrastructure as part of the Open Compute Project.

And we found that open-sourcing our work allows the industry, including us, to benefit from innovations that come from everywhere. And these are often improvements in safety and security, since open source software is more scrutinized and more people can find and identify fixes for issues.

We are also building a number of new products ourselves using Llama that will work across our services.

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

Reality Labs方面,Quest 3是我們最強大的VR產品,近期我們也與Roblox合作。Horizon目前則專注在留存用戶。The next big thing on the Reality Labs side is the launch of our Quest 3 mixed-reality headset at Connect. It's our most powerful headset yet, with better displays and resolution and next-gen Qualcomm chipset with twice the graphics performance.

The metaverse content and software vision continues coming together as well. We recently announced that Roblox is coming to Quest with an open beta on AppLab. For Horizon, the team is focused on retention right now, and we're making good progress on that.

Susan J. S. Li Meta Platforms, Inc. – Chief Financial Officer

第二季營收加速的原因有二:

1.)核心廣告業務成長:成長的主因是去年需求較弱,包括了受到烏克蘭戰爭及俄國停止業務的影響

2.)Advantage+ 產品:我們增加廣告供給及改善廣告效果,包括改善Reels貨幣化率。Advantage+是多重AI賦能的產品,透過Advantage+,我們看到很強的採用率,尤其在電商及零售領域。這讓我們可以幫助廣告主快速測試及使用不同階段的廣告購買體驗。I'll take the second question that you asked around the Q2 revenue acceleration. So I think there were a couple of parts. One was around the acceleration in the core ads business. The second was on the Advantage+ products.

The first is, frankly, we're lapping a weaker demand period, including the first full quarter of the war in Ukraine and the suspension of our services in Russia.

Second, we saw increased supply and improvements to ad performance, including improved Reels monetization as we continue to work down the Reels revenue headwind. And third, there were lower FX headwinds for us this quarter. So those were all 3 things that helped drive the revenue acceleration in Q2.

In terms of the question about Advantage+ specifically, Advantage+ is one of multiple AI-powered ad products that we have right now in the market. With Advantage+ specifically, we're seeing strong adoption and particular success with the e-commerce and retail verticals, and we've seen good traction with other verticals like CPG, especially DTC brands.

That basically enables us to take that same playbook of helping advertisers iterate and test very quickly and apply it to many different steps of the end-to-end ad buying experience. So the feedback and results that we've seen from advertisers is good, and we think it's a really promising area that we're continuing to invest in. But it's one of many ways that we're using AI to continue to sort of help make our ads systems and recommendations and ranking engines more performance to deliver better measurement and results to advertisers.

人

Q: Mark, things move quickly. Like a month ago, we weren't talking about Reels. A quarter ago, we weren't talking about Llama. And start of the year, we were barely talking about AI. If you think back to kind of just how you were prioritizing your time at the start of the year to kind of where you are today and how that's kind of changed, would love to just get some color on kind of the changing priorities and really where you're spending your time.

Mark Elliot Zuckerberg Meta Platforms, Inc. – Founder, Chairman & CEO

我們的優先順序過去幾年一直都維持一致,舉例來說,去年我們AI資本支出受到許多質疑,但現在人們理解到這是一個好的投資。我的意思是,長期而言我們將專注在AI及Metaverse。AI包括排序及推薦系統賦能核心產品,如FB, IG,也包括了系統的安全。Yes. I can start with the first and then Susan can take the second. I actually think our priorities have been pretty consistent for a few years now. I think the way that people hear them might be different.

But for example, last year, I think we were getting quite a bit of critique for the volume of AI CapEx spending that we were doing.

But I think, at this point, it's more well understood that I think that was a good investment, and it's driving results in the near term and enabling us to build some of the new experiences that I think we all think are pretty fundamental.

But no, I mean, I think over time, you should expect that we're going to focus on AI and the metaverse. AI includes both all of the ranking and recommendation systems that power the core apps, so all the content that you're seeing in Facebook and Instagram, all the ads content that you're seeing. It also underpins all the safety systems that we build.